- Cryptocurrency market analysis march 2025

- Cryptocurrency market trends march 2025

- Cryptocurrency market news april 2025

Latest cryptocurrency news may 2025

An additional signal supporting a decline in EUR/USD would be a test of the resistance line on the relative strength indicator (RSI), alongside a possible rebound from the upper boundary of the bullish channel https://elroyale3.com/. A cancellation of the downward scenario would require strong growth and a breakout above 1.1765, which would open the way for a further rise towards the 1.1995 level. On the downside, confirmation of continued weakening would come if quotes break and close below 1.1205, signalling a breakout of the bullish correction channel’s lower border.

🚀 Popping #CryptoNews past week: 🔹Brazil approves first spot XRP ETF as local bank eyes stablecoin on XRPL. 🔹Tether co-founder launches rival stablecoin $USP that offers yield. 🔹Fed’s governor supports rate cut pause while inflation plays out. 🔹Stablecoin Regulation Bill

In the crypto market report covering the week of April 28- May 5 prepared by the ICRYPEX Research team, we have compiled current developments regarding crypto assets, price movements of crypto assets and macroeconomics.

Several significant stablecoin developments marked this week in crypto: – Federal Reserve Governor recognizes stablecoins as legitimate payment tools – Dubai Financial Authority approves Ripple’s RLUSD stablecoin – JPMorgan announces plans for cryptocurrency ETF financing services – Bipartisan support grows for Stablecoin Innovation Act in U.S. Senate – British company BCP receives FCA approval for GBP stablecoin These developments signal increasing institutional acceptance and regulatory clarity for stablecoins across multiple jurisdictions. The combination of traditional finance players and regulatory bodies taking positive stances suggests a maturing ecosystem.

Cryptocurrency market analysis march 2025

Bitcoin’s price action shows significant resistance around the $84,000 level, with support established at $80,635. The cryptocurrency needs to maintain momentum above $83,000 to continue its recovery trajectory.

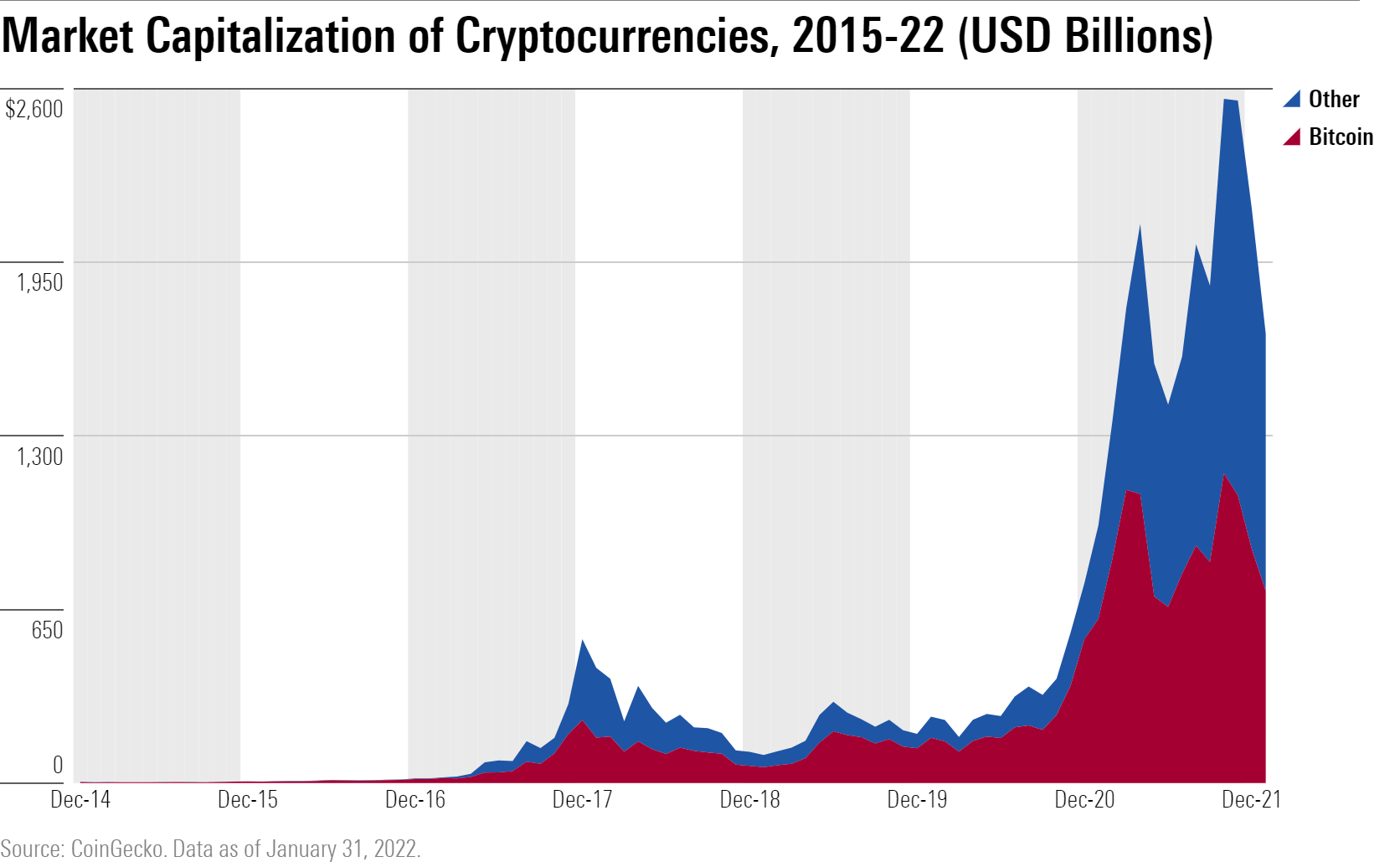

The cryptocurrency market continues to evolve at a rapid pace, driven by technological innovation, increased institutional involvement, and changing global regulations. As 2025 approaches, experts anticipate a transformative year for digital assets. From Bitcoin’s growth potential to the expanding influence of Ethereum and DeFi, the landscape is poised for major developments. This article explores key crypto market predictions for 2025, offering insights into the trends and cryptocurrency opportunities that could shape the future of finance.

The Securities and Exchange Commission (SEC) recently clarified that most memecoins are not categorized as securities under federal laws. This clarification provides a legal framework for meme token creators and reduces compliance uncertainties. However, it also serves as a reminder for investors to exercise caution, as these assets may lack intrinsic value.

Bitcoin’s price action shows significant resistance around the $84,000 level, with support established at $80,635. The cryptocurrency needs to maintain momentum above $83,000 to continue its recovery trajectory.

The cryptocurrency market continues to evolve at a rapid pace, driven by technological innovation, increased institutional involvement, and changing global regulations. As 2025 approaches, experts anticipate a transformative year for digital assets. From Bitcoin’s growth potential to the expanding influence of Ethereum and DeFi, the landscape is poised for major developments. This article explores key crypto market predictions for 2025, offering insights into the trends and cryptocurrency opportunities that could shape the future of finance.

The Securities and Exchange Commission (SEC) recently clarified that most memecoins are not categorized as securities under federal laws. This clarification provides a legal framework for meme token creators and reduces compliance uncertainties. However, it also serves as a reminder for investors to exercise caution, as these assets may lack intrinsic value.

Cryptocurrency market trends march 2025

A fascinating cultural development in the cryptocurrency sector has been the emergence of “memecoins.” These cryptocurrencies draw inspiration from internet memes and online humor. The most popular of these memecoins is Dogecoin. Based on a Binance survey of 411 users, 49.64% of users have a very bullish price prediction sentiment. Dogecoin was originally created as an alternative to Bitcoin, with the Shiba Inu dog from the “Doge” meme as its symbol. Its price has increased due to social media activity and endorsements from notable individuals such as Elon Musk.

The common narrative is that cryptocurrency ownership skews young. And that’s largely true. About half of Millennials and Gen Z respondents globally said they either currently own crypto or have in the past, at 52% and 48%, respectively. That’s significantly higher than the general global population, at 35%.

Notable projects like Pudgy Penguins transitioned into consumer brands through collectible toys, while Miladys gained cultural prominence within internet subcultures. Similarly, the Bored Ape Yacht Club (BAYC) evolved as a cultural force, attracting widespread attention from brands, celebrities, and mainstream media.

Cryptocurrency market news april 2025

XRP gained renewed attention as rumors swirled about an ETF launch and regulatory settlement with the SEC. These developments strengthened XRP’s market position, pushing it into the top five cryptocurrencies by market capitalization.

According to Crypto Rover, Bitcoin historically demonstrates a bullish trend during the month of April. This pattern has been observed in previous years, where Bitcoin often experiences price increases during this period. Traders may consider this historical trend when making investment decisions, especially as key indicators point to another bullish April in 2025.

Solana has shown positive movement but lacks strong organic demand. Its total value locked (TVL) remains low, raising concerns about network stability. A breakout above $150 with high volume is necessary for further gains and indication of a potential bullish building momentum.

🏦 BlackRock: Its Bitcoin ETF surpassed $50 billion in assets in just 15 months, underscoring growing institutional demand for crypto exposure. 🏦 MicroStrategy: Increased its Bitcoin holdings to 447,470 BTC, continuing its long-term accumulation strategy.

📈 Analysts anticipate Bitcoin’s potential surge to $100,000, fueled by institutional demand and favorable macroeconomic conditions. ⚠️ However, excessive optimism could trigger short-term corrections, making risk management essential.